This is an edited excerpt from the

Crossbeam Partner Playbook, a 65-page guide for B2B SaaS partner managers to drive more revenue, get rewarded, and be an indispensable part of your company.

Download it here.

Partnerships are an exchange. Like your lunch table in elementary school, you offer something and they offer something and you either trade or — when you’ve got peanut butter and a chocolate bar — combine dishes to make something that’s greater than the sum of its parts.

At Crossbeam, we often think about successful partnerships in terms of the data involved. Whether it’s a channel, tech, or strategic partnership, partnerships generate more upside when there is:

- Data accessibility in both directions

- A clear playbook for what to do when data between the two parties intersects

- A way to measure and quantify success when that playbook is run

In the 2010s, comparing data sets with partners was done ad hoc and manually via spreadsheets, bespoke integrations, or just phone calls and dumb luck. Being a partner professional in 2020 means you can be smarter about your partner operations (aka Ecosystem Ops) and use technology to meet these needs at scale—all while protecting your company’s most sensitive data.

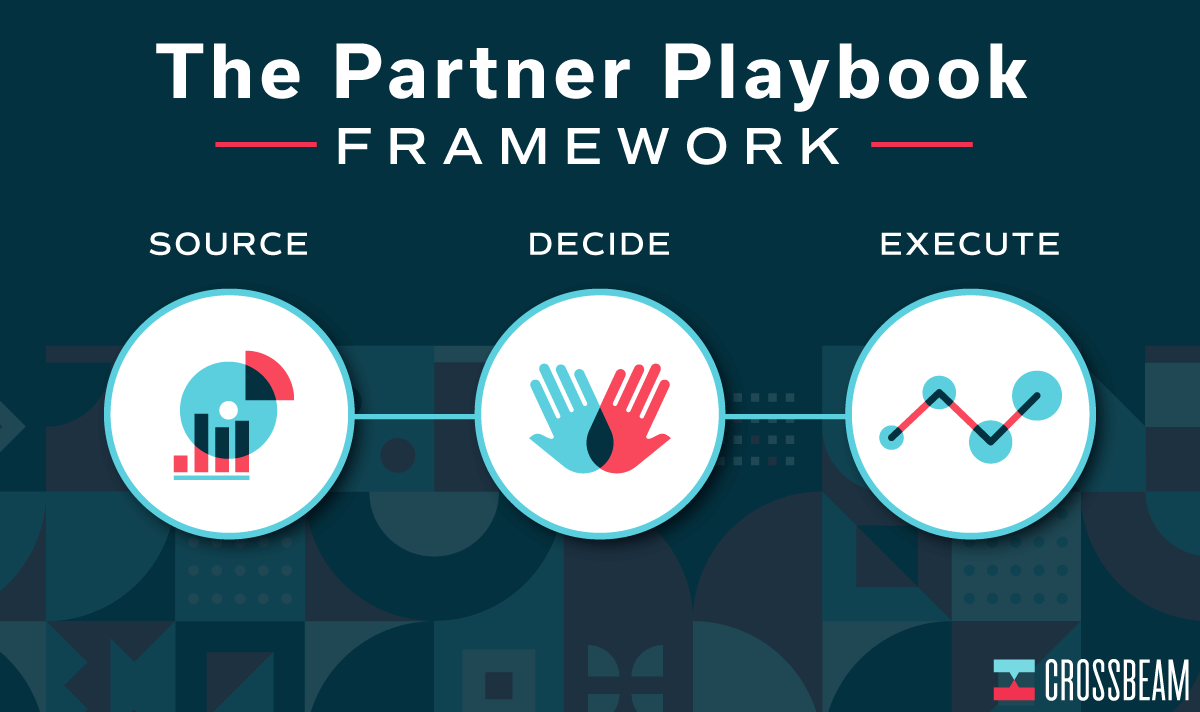

In this post, we’ll cover:

- How to source the data you need to choose the right tactic

- How to decide which partners to work with

- How to execute the tactics

Step 1: Source

Account Mapping

Account mapping is taking a list of your customers or potential customers (“accounts”) and cross-referencing (“mapping”) it against a partner’s list of current or potential customers. When matches occur, the two parties can opt to share more data about the underlying accounts, such as the nature of their relationship and the sales rep or account manager who owns it.

If partnerships are exchanges of data, account mapping allows you to get a bird’s-eye view of what’s possible.

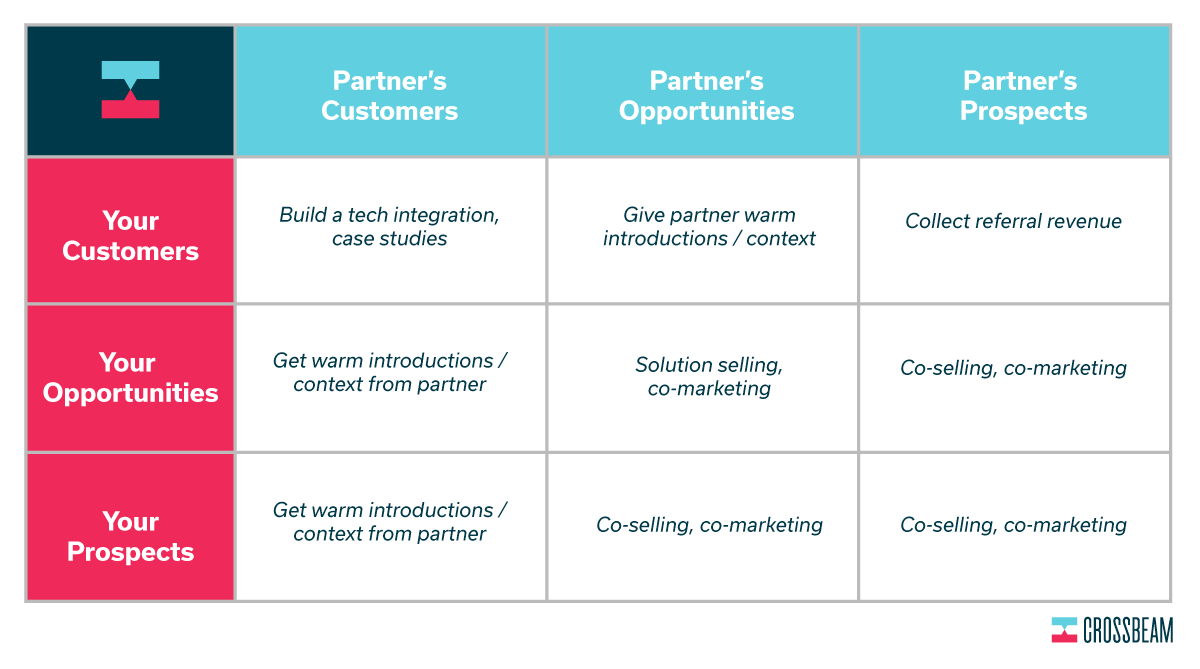

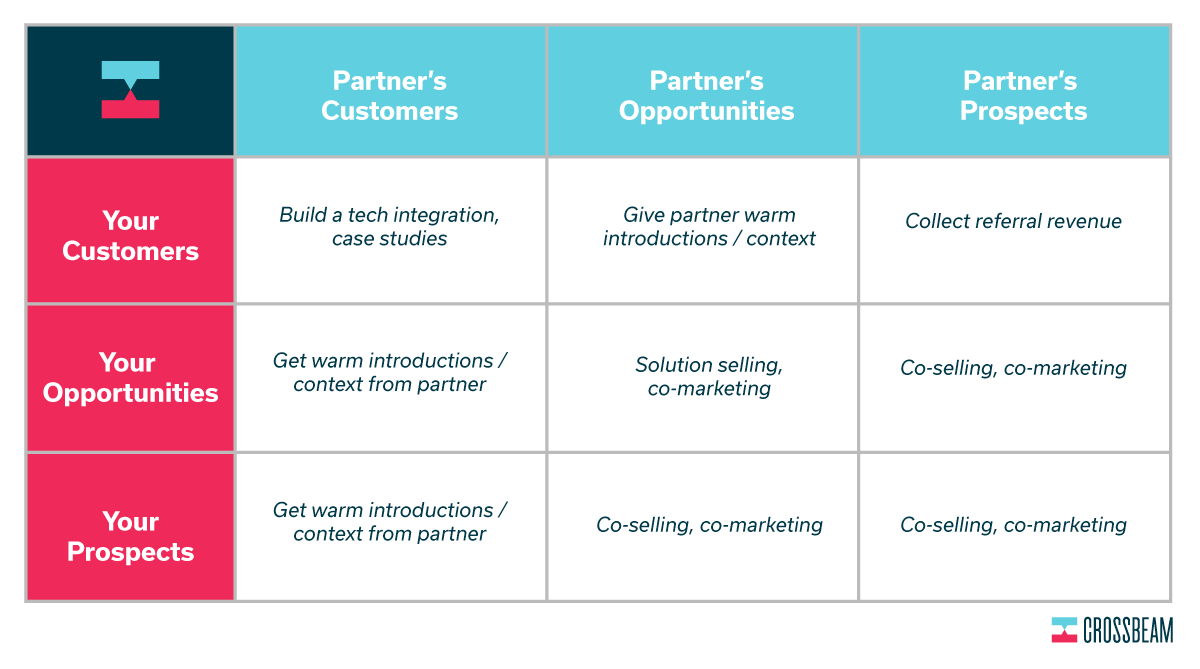

On its own, this information can help steer you toward high-level decisions like which partners are the most valuable (more on that later). But it gets especially interesting and valuable when you analyze the actual accounts inside these overlap lists. Each intersecting account is an opportunity for value-creating action. You can visualize the different actions you can take from this Source step in a 3×3 grid.

In this grid, each row represents one of your account lists and each column represents one from your partner. The boxes in the middle show actions you can take when those specific lists overlap.

Example #1: I compare my customer list with my partner’s customer list and we find a high number of overlapping customers. As a result, we decide to build a new technology integration that seamlessly integrates our products. We know exactly which customers to contact and market the integration to, and once adopted the integration helps increase user retention for both of us. Account mapping made our product roadmap smarter, our products stickier, and our partnership stronger.

Example #2: I compare my opportunities list with my partner’s opportunities list and we find that we have a very high number of overlapping opportunities in the northeast region. We connect our respective sales reps who cover that region and they use the account mapping results to share insights and co-sell into these shared opportunities (more on that later, too). We increase each other’s chances of success and close rates by telling a unified story about how our products create value together. Everyone wins and our partnership grows.

Account mapping like a modern partner professional

Modern teams use a partner ecosystem platform (PEP). A PEP will connect your lists securely and keep you constantly up-to-date on any changes. Rather than manually searching spreadsheets you can set up the connection once and forget it.

Most importantly, a PEP serves as a trusted third party that can securely manage the lists and reveal overlaps while keeping the rest of your data private and secure. It’s kind of like an escrow service for your account data.

You cannot operate efficiently as a partner professional if your team relies on spreadsheets to map accounts. Partner managers using Crossbeam have shared that they save 20 hours or more each week by not doing account mapping manually — all while getting fresher and more accurate results.

“I asked my team, do you want me spending time in spreadsheets or do you want me spending time in front of partners?” says Chris Formosa, who works on technology partnerships at FullStory.

As a result, a PEP changes your account mapping from an insecure, static process into a secure, dynamic process. And that can open up lots of opportunities to streamline your Ecosystem Ops. For example, you’ll be able to:

- Send the results of your account mapping back to Salesforce, so your reps can see which partner they can reach out to when trying to close a deal.

- Send alerts about new overlaps to Slack so you are instantly notified about new opportunities to collaborate with your partners.

- Use the PEP combined with your CRM to track partner-influenced pipeline and revenue as deals close.

None of the above is possible with spreadsheets.

Step 2: Decide

Once you’ve completed your account mapping exercise and sourced the right data, you can decide which partners you’ll work with and what problems you’ll be solving.

Vetting possible partnerships

What you do next depends on the data you sourced from your partners in the previous section as well as your individual goals. You can think of a partnership formula as:

Available shared data + What your company needs + What their company needs = Partnership plan

“It all depends on the goals,” says Cody Jones, Head of Partnerships at Zapier. “Some companies care about lead generation. Some just care about reducing churn. They all have their metrics that they are evaluating your partnerships by. Know that upfront.”

How many overlaps are enough?

A low friction way to kick off a partnership is to agree to do some account mapping in your PEP and share only the number of overlaps, but not the identity of the accounts within those overlaps. This means, for example, you can see that 41% of your customers are also their customers, but not reveal who those customers are or anything else about those accounts.

One benefit of starting with high-level overlap counts is that you can start to get a sense of the size of the opportunity if you were to go deeper. You can use this high-level data to compare against the overlap counts of other partners and infer the size of the upside in the potential partnership.

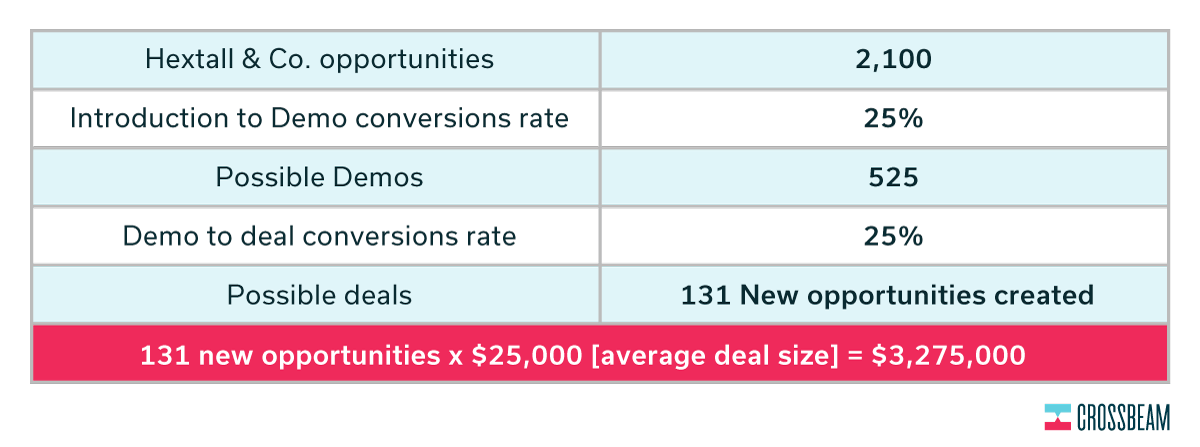

An example: You and your potential partner Hextall and Co. use your PEP to do an account mapping exercise. You learn that Hextall has 2,100 customers on your target list that they could potentially introduce to you. Your average deal size is $25,000. What’s that worth to you? Just do the math:

A partnership with Hextall and Co. has an immediately addressable market of $3,275,000 in pipeline. And that’s just today — as your target list evolves and their customer list grows, a steady stream of incremental opportunities will emerge.

A partnership with Hextall and Co. has an immediately addressable market of $3,275,000 in pipeline. And that’s just today — as your target list evolves and their customer list grows, a steady stream of incremental opportunities will emerge.

Many mature partner programs, such as Zendesk, use this technique to quickly determine if a potential partnership is worth pursuing.

Vetting for new technology integrations

Before building a technology integration, one way to ensure success is to make sure that there is a big potential user base. Especially if you’re a startup or mid-sized business, chances are your team will be the one creating the integration — so make sure you’re using your team’s resources wisely.

A good integration…

- …is used by your customers to fill in use case gaps that your product team can’t or won’t tackle directly.

- …makes your solution more “sticky” by integrating it with other aspects of your customer’s workflow.

A good rule of thumb before mapping accounts is to start with a qualitative analysis of the potential integration partner: do our ideal customer profiles overlap? Do we both have the necessary APIs to develop an integration that contains the functionality we would need? Ideally, these early screening questions can be enough such that 70-80% of the partners you vet are worth moving forward. Some caveats here: getting a hit rate this high will require some upfront work on your end:

- Work with market leaders at first. If you are early in your integration program, chances are you are building integrations for market leaders with several orders of magnitude more customers than you. The bigger their lists, the higher hit rate when looking for overlaps with yours. And while you may have to do the legwork, they likely have streamlined partner programs you can join.

- Compare messaging. Use LinkedIn and your potential partner’s marketing site to hone in on their target customer persona. Are your brands, voices, and sensibilities compatible? This can preview any friction that might exist in combining customer bases

- Augment your data. Use public resources like Forrester, G2, Owler, Crunchbase, and CB Insights to get additional context.

Step 3: Execute

You’ve sourced the data using account mapping. You’ve decided which partners you will work with. Now it’s time to execute your solutions.

Before we continue, you’ll be sure to notice a recurring theme in what follows: Each partner ecosystem is different. Customize each of these to your own market, organization, and vision.

Co-Marketing

Co-Marketing is when two or more companies partner to create a shared marketing campaign, creating an opportunity to cross-pollinate their audiences. This joint project is usually “co-branded” featuring the logo, messaging, and branding from both partners.

A savvy SaaS partner manager uses co-marketing to expand their reach and collect leads—sort of like when one of your friends introduces you to new people.

Your co-marketing tactics are only limited by your imagination and your resources. As a result, when discussing co-marketing we like to share what’s possible rather than offering recommendations.

Some examples of co-marketing include:

- Co-Branded email campaign

- A blog post

- A how-to article or help center page

- Podcast

- Webinar

- A live event or private dinner

- Virtual event

- Case studies

- Testimonials

- White papers

- Ebooks

- Direct mail (yes, you can use old tactics with new data!)

The Crossbeam co-marketing formula

We’ve met with hundreds of partnership leaders, and we’ve observed a consistent strategy for building a co-marketing campaign.

Step 1: Candidly assess priorities with your partner

When you embark on a co-marketing campaign with a partner you’re making a commitment to one another. As the “co” suggests: You’ll need to cooperate and share efforts and resources to help one another meet your goals. Before you begin a co-marketing campaign be candid about what success looks like and who does what. What are you trying to accomplish?

“I have a very clear set of questions that I ask every time. It goes beyond more than who you are and who you’re for,” says Maddy Martin, Head of Growth and Education at Smith.ai.

It’s like your first day with a new roommate: You’ll probably have to set some ground rules.

“We take an educational approach,” says Martin. “If you said to me, ‘Let’s do a webinar’ and you sent me your sales deck, that’s a huge turn off. I’m not bringing my audience to you for a pitch.”

An asymmetry in contributing efforts or resources, or a misunderstanding of audiences, can lead to frayed relationships and a loss of credibility for you both, internally and externally. In most cases, you’ll want to create a basic agreement and get clear on some basic goals.

“We ask people to do a marketing agreement first, and they may freak out, but once that’s in place it’s easy,” says Francois Grenier, Head of Technology Partnerships at Typeform. You don’t have to live and die by the agreement but it sets expectations. “At the end of the day it’s about having people willing to work together.”

And if you don’t set expectations up front, you’re liable to get stuck after taking initial steps.

“I’m done with partnerships that make great press releases and nothing more,” says Andrew Lindsay, VP of Corporate Development and Business Development at HubSpot. “It’s easy to announce a partnership, it takes much more work to make it valuable for customers.”

Some details to consider including in your agreement:

- Approval process – Who approves assets? Who is editing?

- Monetization – Who pays

for the campaign? - Paid campaigns – Is either party paying for advertising?

- Branding – Is this co-branded? Is one company more prominently featured?

- Obligations and deadlines – Who is doing what and when?

- Lead swapping – Who captures data from the audience? Is that data shared with partners? How?

- Measuring success – Is the campaign an effort to promote integration installations? General brand awareness? Sell event tickets? Generate email leads? Be clear and set goal numbers.

- Failure to comply – What happens if someone doesn’t hold up their end of the agreement?

- Distribution channels – How will they share your co-marketing campaign? Is your audience there?

- Audience quality – When your partner asks their audience to do something, do they do it? A partner can boast they have, say, 500,000 email subscribers. But that’s less impressive if only 150 show up to the next webinar.

(Read more about partner agreements here)

And remember: Not every co-marketing effort needs to be a huge lift. You can start small (see “The crawl-walk-run mindset”).

Step 2: Know your shared customers / opportunities

This is one of the primary reasons people do account mapping, whether it’s with a partner ecosystem platform (PEP) like Crossbeam or with an old-school spreadsheet approach. Without a sense of your possible audience size, your co-marketing campaign may be dead on arrival. Some tips:

- For technology partners, nearly all overlapping audiences are relevant. Shared customers can adopt your integration, shared opportunities can better understand value, and shared targets can get educated on both products at once.

- For channel partners, software vendors are typically looking to “activate” new leads and advance existing deals, so they look to the intersection of their sales pipeline or target list with the channel partner’s existing relationships. This helps narrow down the lists to only the overlaps where co-marketing can drive the desired outcome.

- For strategic and co-selling motions, PR is often a goal so the audience is likely universal. Build the biggest megaphone possible by targeting the superset of all your lists and all of your partner’s. In this case, you’re using account mapping data to understand the total unique list size, prevent duplicate outreach, and customize your messaging based on the overlap (or lack thereof).

In all cases, it’s about adjusting from “spray and pray” to a smarter and more targeted, data-driven approach. For co-marketing motions that rely on email, you can use this shared list as the starting point for any email send. For co-marketing motions that rely on advertising or paid campaigns, you can use these lists for retargeting.

Step 3: Protect your audience’s data

Remember through all this that a well-done account mapping exercise has accomplished three things:

- Identified the accounts where you and a partner already both have a relationship of some kind and are able to engage. You can team up to engage this audience in unique and personalized ways.

- Identified the accounts where only you hold a relationship, and kept that account’s data secure and private to you. You can collaborate on the content sent to this audience, but the actual outreach and tracking is your responsibility.

- Identified the accounts where only your partner holds a relationship, and kept that account’s data secure and private to them. You can collaborate on the content sent to this audience, but the actual outreach and tracking is your partner’s responsibility.

While we’ve seen countless examples of companies bending these guidelines to cross-pollinate or share lists, the safest and most responsible approach is the division of labor outlined above. Again here, you can only execute on this style of outreach if you are using a secure third-party PEP to do the account mapping. If you’re just emailing spreadsheets (or not sharing any data at all) your options are much more limited.

Depending on your strategy, you and your partner can now reach out to these groups in custom ways without inadvertently sharing or exposing information about accounts that your partner doesn’t already have.

Step 4: Meet them where they are

So how do you do this outreach? Creating the exact campaign is the fun part, and depends largely on your market, your audience, and your product. Some examples:

- Paid for entirely by its co-marketing partners, Sendoso once hosted a tailgate experience called the “Send Zone,” where the team traveled to sporting events in an RV co-branded with partners who sponsored the event. Each company involved was allowed to invite prospects in that region to enjoy refreshments, play lawn games, network, and learn about their solutions.

- Typeform writes detailed how-to blog posts that tell the story of how a shared customer uses a new integration. “It gets really hands-on and product-focused,” says Grenier. “I am fond of that, because it’s practical for our audience which is a lot of small businesses and mom and pop stores. This drives stickiness and gets them where they need to go.”

- Unbounce created a “lookbook” with partners that is a collection of visual inspiration for things like landing pages.

- Zendesk and Stella created a webinar about how a customer used their shared solution.

- InVision once created an entire documentary with its customers and partners called “Design Disruptors.”

- Smith.ai creates infographics using its partner’s data.

- PartnerStack hosted its “Partner Power Summit” featuring pre-recorded talks from its partner ecosystem.

- At industry events, Sailthru invites seven of their customers with seven customers of a partner to a private dinner to introduce them all to one another.

- Each year, Unbounce hosts themed days or weeks with its partners. An example is “Digital Agency Day” a collection of 10-12 online talks on topics of interest to its agency customers. It offers a 1:1 lead exchange up to a certain threshold. If partners meet that threshold, they unlock the full list. Previous events have had 10,000 registrants.

Most common, however, are digital experiences like webinars and blog posts.

Co-Selling

While co-marketing is designed to stimulate the top of your funnel and drive new leads into your business, co-selling is the act of empowering your salespeople with more data, resources, introductions, and contacts to help them close more deals, faster.

Co-marketing is getting contacts ready to buy, co-selling is making sure your team has all of the tools to close the deal.

You’ll notice in the 3×3 grid that co-selling or “introductions” appears several times. Each of these contexts requires its own approach:

- Prospect to prospect co-selling. Sometimes called “solution selling”, this when two partners are approaching a new possible customer with the positioning that using their solutions or services together is the best way to meet the customer’s needs.

- Opportunity to opportunity co-selling. Same as above, however when involving an opportunity, account executives usually (and understandably) need a bit more convincing.

- Customer co-selling. Sometimes referred to as “cross-selling” this is when you or a partner introduces the other side to an existing customer. This occurs when you have an integration or technology partner who’d like to sell to an existing customer of yours. Co-Selling involving an existing customer requires a thoughtful approach with your internal sales and customer success teams. This is what most B2B SaaS partner professionals are referring to when using the term “co-selling.”

Co-Selling can help you fill in gaps. If you are co-selling with a technology partner, you are filling in a gap in your functionality and value proposition. If you are co-selling with a channel partner, you are filling a gap in your ability to manage or sell your services.

“The co-selling partner might understand the prospect better because they created the relationship while the vendor understands their own product better than anyone,” says Shawn Ragell, Partnerships lead at Close. “That combination is powerful.”

A general co-selling process might look like:

- Map your data using a partner ecosystem platform. A high number of overlaps means that the partnership is worth dedicating resources to.

- Pick the best approach: prospect to prospect co-selling, opportunity to opportunity co-selling, and/or customer co-selling.

- Get your collateral in order. Have a shared Google Drive with all of the info AEs need to execute.

- Introduce AEs to one another. Each sales team needs to trust one another. Do this formally at structured events or informally as meetups.

- If there is a high number of overlaps, reveal additional account information such as the nature of the relationship and the team member who owns the relationship.

- Agree to a “motion” through which leads will be passed along to the receiving partner. You should also agree to a regular cadence on which this motion will take place. It could be quarterly or monthly.

- Agree to a regular cadence on which this motion will take place. It could be quarterly or monthly, but the best companies use their PEP to surface these in real-time as they happen.

…And adjust

Being a partner professional is like being a scientist. You have a hypothesis as to what will move the needle, but you can never know for sure. Thanks to real-time account mapping provided by partner ecosystem platforms, you can usually see the impact of your partner motions quickly and adjust accordingly.

Thus, account mapping is not something you do once or on an ad hoc basis, but something happening all the time. Think of it like a GPS: Reference your account mapping to make sure you’re going the right direction at the right speed. If you make a wrong turn, the route can be recalculated in real-time.