By Olivia Ramirez

July 31, 2023

The right partners and integrations can help you sell to new personas, verticals, and markets. Manage the expansion with grace, and you’ll open the door to countless new opportunities and multiply your revenue. A few examples:

-

Close sold to an inbound lead in a new vertical

with the help of a services partner. Once their services partner integrated their new customer’s tech stack, they were able to apply similar dev work to other customers in the vertical and generate many new leads within that vertical. -

Reviews.io gained 100s of clients in the DACH region

(Germany, Austria, and Switzerland) by partnering with Shopify+ agency partners in the region. 80% of their customers in the DACH region use Shopify, compared to just 34% of their customer base in Australia. -

Aircall expanded its co-selling motions across markets and gained access to customers in new verticals with help from their strategic partners Salesforce and HubSpot. As a result, they increased their revenue contribution from partnerships from just 10-15% to more than 50% of new sales per quarter.

Expanding your sales motions and your ideal customer profile (ICP) is exciting. But each new persona, vertical, and market brings a whole new set of attributes along with it that you and your sales team need to understand. Jump in before you’re ready, and you could struggle to build the reputation you’d like and get stuck backtracking from avoidable mistakes.

For example: What are your new buyer persona’s pain points? What key performance indicators (KPIs) are they measured on? What business language

do they speak? Do your potential buyers in the new vertical or region buy differently than the ones you typically sell to?

Whether you’re selling to a new go-to-market (GTM) team or to new buyers in France (Bonjour!), with a little help from your partners, you can enter the sales conversation with confidence.

Below, we’ll share three tips for leaning on your partners to expand to a new persona, vertical, or market.

Tip #1: Learn about your new buyers

Let’s say you typically sell your product to marketing teams. Through your integration with your new tech partner, you’ll also be able to sell to sales teams. Not only will you need to gather social proof and case studies that resonate with the sales persona, you’ll also need to learn about their pain points, their KPIs, their goals,

how they like to communicate,

and more.

Your partner can help get you and your sales team up to speed quickly — They’ve fine-tuned their sales motions for your new buyer persona and can help you accelerate the “market research” phase.

A quick checklist of questions to ask your partner:

-

What are some of the titles of the new buyer persona that we may not be familiar with?

-

What kind of pain points have you observed for the buyer?

-

How has the buyer’s behavior changed over the past year(s)? For example: Are they buying more via social selling and communities? Are budgets tight?

-

What goals or KPIs are you seeing your buyers care about most?

-

What is the communication style of the buyer or of stakeholders in the vertical or market? For example: Do they prefer comprehensive, polished communication or more casual communication?

-

What are some of the community, reviews, and social media platforms that the buyer or those in the vertical or market frequent?

-

How is selling in the particular region different from selling in [my region]? What are some of the century-old habits

of buyers in the region? -

What kind of challenges have you encountered in the legal and procurement process for this particular buyer?

-

What are some of the nuances of how buyers in the region or vertical handle conflict management?

-

What are some of the vertical-specific or regional-specific challenges you’ve seen that you think our product could help solve?

-

What are some of the favored tech products in our category (and otherwise) in the vertical or region?

If your company is in the ecommerce space and looking to expand to various markets in Europe, consider how ecommerce shopping varies drastically between countries. For example: In the US and Germany, 79% of shoppers

in both countries said they begin their product searches on Amazon. In the Netherlands, only 13% of shoppers said they use Amazon most. In the US and Germany, this could present an opportunity to partner with Amazon and its merchants and access its customer base. Alternatively, an Amazon competitor could present a fresh alternative in the US and Germany. They could also fill an existing gap in the Netherlands or face challenges competing against more favorable hyperlocal vendors.

Your tech or channel partner can give you insight into how to sell to your buyer and also help you skip ahead in your competitive analysis. Your agency or system integrator (SI) partners also may have years of experience working with your new buyer or clients in the new region. They’ve implemented various products for your prospects and can help educate you about their technical needs, business goals, and roadblocks.

A few examples:

When Reviews.io

expanded to the DACH region, they sought the help of local agency partners and Shopify+ partners in the region. Specifically, best-in-breed agencies that had close, ongoing relationships with existing clients in the region were able to vouch for Reviews.io’s product and pull them into joint pitches for their clients. As a result, the Reviews.io team gained 20 clients

through a single agency partner in just six months. These partners helped educate the Reviews.io team about their clients in the region, including conflict management etiquette and legal processes.

In another instance, Reviews.io

observed that their prospect had a unique challenge specific to the DACH region that their joint solution with LoyaltyLion

could help solve. Germany’s regulations around advertising CBD and hemp products presented challenges for the site’s visibility and brand reputation among potential buyers for CBD and hemp store VAAY.

Reviews.io and their tech partner LoyaltyLion

were able to step in and help VAAY reach buyers through incentives and consumer reviews. Through their understanding of Germany’s regulations, they were able to solve a specific pain point for their new customer.

The team at Skylark

relies on its agency and SI partners to educate them about new markets. Their global system integrator (GSI) partners specialize in projects in artificial intelligence (AI) and have access to Fortune Global 100 and 500 clients. Partners like Accenture can help Skylark sell to a particular type of company and also help educate Skylark about the nuances of those companies. They’re experts in their market and have worked with many similar clients and tech stacks. As a result of partnering with GSIs, Skylark has expanded into niche customer bases

in the UK and expanded their ICP.

“We don’t do marketing, other than partnerships,” says Justin Fyles, Managing Director at Skylark.

Tip #2: Learn about your buyers’ ecosystems

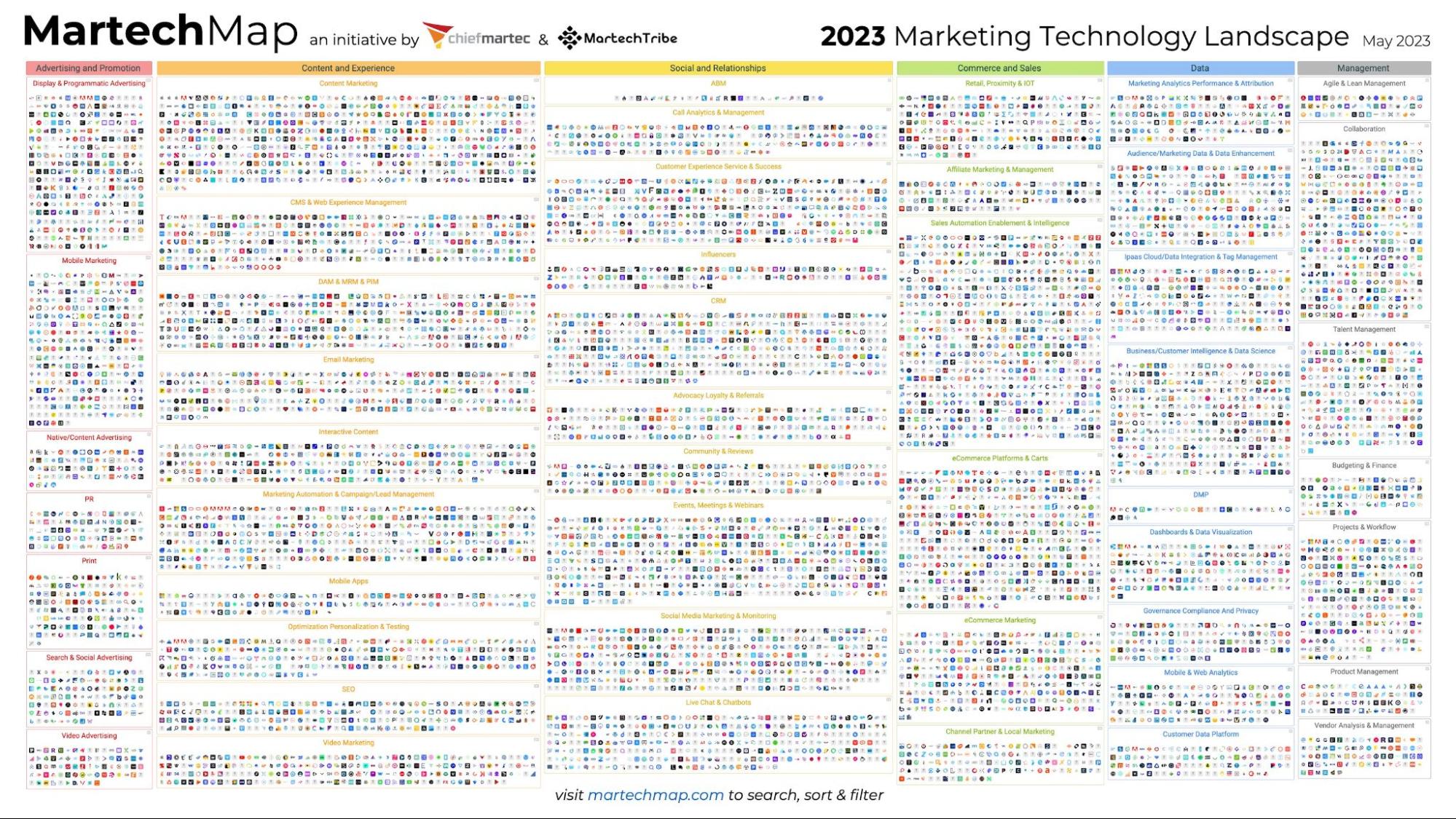

With a new buyer comes new tech stack preferences. If you’re selling to marketing teams, you’ll need to get up to speed on the current martech landscape. You’ll need to understand how your product will (and won’t) work with various tools within a marketer’s tech stack, expand your Ecosystem accordingly, and help your sales team become tech stack experts.

The martech landscape includes 11,038 tools in 2023. That’s a lot of tools for your sales team to familiarize themselves with! The best sellers are consultative and help their prospects solve pain points that extend beyond the product they’re selling. Your partners can help you and your sales team understand which tools they should prioritize learning about and help them understand how their prospects are using the tools in their tech stacks.

Above: Image courtesy of chiefmartec.com.

Above: Image courtesy of chiefmartec.com.

Your tech partners who already sell to your new buyer or into your new vertical or market already integrate with many of the tools your prospects are using. Understanding your partner’s Ecosystem can give you direct insight into your new buyers’ tech stacks.

You can learn about your partner’s Ecosystem (and also your buyer’s Ecosystem) using Partnerbase, our network of every partner Ecosystem. Simply type your partner’s company name into Partnerbase

to see all of their tech and channel partners. If you’re expanding to a new vertical or region with your partner, filter their partner list by “Industries” or “Location”.

Above: Search your partners in Partnerbase.com

and filter by “Industries” or “Location” to identify their partners in a particular vertical or region.

Additionally, when you have a new prospect in your new vertical or market, you can use a partner ecosystem platform (PEP) like Crossbeam

to uncover insights about their tech stack. If your prospect overlaps with any of your tech partners’ customer lists, then your prospect is using your partner’s product in their tech stack.

Above: The account mapping matrix

in Crossbeam showing the number of prospects overlapping with your partner’s customers.

A few examples:

When the team at Census

learns that their prospect has recently bought one of their tech partner’s products, they initiate an outreach sequence

mentioning their partner’s product. As a result of including tech stack insights in their sales outreach, they observed 34% higher annual contract values (ACVs) on partner-influenced deals, compared to non-influenced deals.

“The thing about Crossbeam that’s nice is you can see a prospect’s tech stack. You gain information that you can’t scrape off a prospect’s website,” says Sylvain Giuliani, Head of RevOps and Growth at Census.

RollWorks’s

onboarding customer success managers (CSMs) uncovered tech stack insights

using Crossbeam to recommend relevant integrations to their new customers. As a result, they saw a 17% increase in customers who had adopted at least one additional integration and a 16% faster time to first value (TTFV) in a two-quarter period.

Drift

uses the Crossbeam Salesforce Widget

to quickly understand which of their prospects are in their partners’ customer lists. When a prospect becomes a customer of one of their strategic partners, they’ll wait 90 days for their partner’s new customer to complete their onboarding process and then submit a partner intro request (PIR) to the partner. They’ll ask their partner for context about the account, like who the stakeholders are with buying power or what the sales cycle was like, or they’ll ask for a warm intro. They know that if their prospect is using their partner’s product, then their prospect would also benefit from using Drift.

Andy Cochran, Head of Strategic Alliances at Drift, shares how he initiates PIRs and the “fast follow” in his 2023 Supernode talk.

Tip #3: Gather value statements and establish your reputation among your new buyers

If you’ve begun selling into a new persona with your partner, it’s possible that one GTM team in a particular account might use your partner’s software and the other GTM team uses yours. Let’s say the marketing team uses your product and the sales team uses your partner’s product. Your partner can help you cross-sell

into the sales team, and you can help your partner cross-sell into the marketing team. Your partner can vouch for you to the internal stakeholders they know at the account, and those internal stakeholders can put in a good word for you to their colleagues in another department.

Using Crossbeam, you can identify which of your customers are already customers of your partner. If you don’t

have overlapping customers in the exact vertical or market you’re expanding into, gather value statements or case studies from different customers you have in common with your partner to help showcase your joint value proposition. Your partner can speak with their existing relationship and share how they could apply similar practices to their particular use cases.

If you do

have a mutual customer in the new vertical or market, start gathering value statements and developing your first case study. These value statements and case studies will be critical for your sales team to communicate the effectiveness of your joint solution. Bake these value statements into your sales pitch decks for your new buyers. You’ll also need to adjust the messaging of your pitch decks to speak directly to your new buyer persona, vertical, or region.

An example slide from a pitch deck targeting HR professionals:

A slide from Zenefits’

pitch deck to HR teams, courtesy of Cirrus Insight

An example slide from a pitch deck targeting marketers:

A slide from Zuora’s

pitch deck to marketers, courtesy of Cirrus Insight

A few examples:

Remember how Reviews.io discovered how they could help solve a regional-specific problem for their customer VAAY with their tech partner LoyaltyLion? After helping VAAY achieve key milestones using their joint solution, they published a case study. They then used that case study to gain similar customers in the region.

RingCentral’s

partnerships team collaborates with its Vertical Sales and Solutions Engineering teams to develop bespoke integrations for new customers in specific verticals. Then, they expand the integration to apply it to other customers in the vertical. Using this method, RingCentral is able to sell to and onboard customers in new verticals and upsell 3x as frequently

via their integrations.

Additionally, the dollar amount of those upsells is 4x the amount of upsells with no partners involved.

When Spectrm

launched a strategic alliance with a partner who has a large global presence, they needed to figure out how to develop relationships with their partner’s sales and customer success teams in each region they were targeting. They started by teaming up with just one sales rep and customer success duo in one office.

Once they initiated a win, they published a case study with their partner and their mutual customer. They then used the case study to win over more of their partner’s sales and customer success reps across their global offices and win more mutual customers across regions. Now, more than half of Spectrm’s net new deals

are influenced by partners.

Above: A case study

showing how Spectrm teamed up with their alliance partner Meta

to grow their mutual customer account

–

More resources you might like:

-

The Ecosystem-Led Growth Race Between the US and Europe: Who’s Winning?

-

Everything You Should Know About Launching a Startup Partner Program

-

Map Your Partner’s Org Chart and Boost Partner-Sourced Revenue by 40%