If you’re launching a new partner program, you’ve got the biggest challenge of all — getting buy-in. No results (yet) means little headcount and resources for partnerships. Without the people and things you need, it’s difficult to drive results.

… And the cycle continues. No buy-in, no results. No results, no buy-in.

Why not look to other companies’ results to get the wheels turning? They were in your shoes once, and just look at them now (read: 95% of Microsoft’s revenue flows through its partners).

We’ve compiled 25 articles that show the business impact partnerships have had on B2B SaaS companies like yours. Pick your favorites and share them with your CEO (cue the collective nods of approval).

Sylvain Giuliani, Head of Growth and Operations at Census, sends his sales team ecosystem qualified leads (EQLs) regularly. To do so, Giuliani maps their target accounts with his partners’ customer lists to identify the most promising opportunities to engage his sales reps with. Additionally, he gets alerts in Crossbeam each time a target account becomes a customer of one of his partners.

“We know a prospect just bought our tech partner’s product and that’s a very strong signal for us to start the sales process because it involves migrating data and ingesting data in new tools, and that’s really what we do as a business. Those types of events are super relevant from a timing point of view,” he says.

In some cases, the partner offers a warm intro for the sales rep.

“Having sales intel from Crossbeam allows us to be more in control of a deal. This means we can be more confident in our negotiations and pricing discussions with clients. We don’t have to anchor ourselves to a lower contract value,” says Giuliani.

Send this link when… You need to get buy-in from your sales team, or you’re looking to make the investment in your first partner ecosystem platform (PEP).

In late 2018 at a Shopify Unite conference, Harvey Finkelstein, President at Shopify, addressed the e-commerce platform’s merchants to advocate for the importance of partnerships — especially in prevailing against Shopify’s all-in-one competitors.

Shopify’s growth model has relied heavily on integration development and a host of public and private apps built by partners for merchants. With the help of its agency and ISV partners, Shopify has built a community of more than 1,000,000 businesses on the platform. In 2017, Shopify gained $673 million in revenue, and its partners generated $800 million through the platform. Three years later, Shopify’s revenue surpassed $12.5 billion, and its partners generated approximately $50 billion.

Send this link when… You want to show the potential impact of investing in the development of your channel and tech partner programs and how each will drive value for customers.

System integrator (SI) Accenture surveyed more than 1,100 C-suite and VP-level executives in 2020 to identify four levels of operational maturity. Accenture refers to the highest level of operational maturity as “future-ready”. They found that companies that advance from the third tier of maturity to the fourth (“future-ready”) increase in profitability by 5.8 percentage points.

Accenture cites ecosystem partnership strategies as a defining factor in “future-ready” companies.

From the report:

Being future-ready requires a flexible operating model—an optimized combination of multidisciplinary teams and technologies on demand that work across a broad ecosystem of partners. The goal: Deliver exceptional business outcomes at scale, from anywhere, anytime.

Of their survey respondents, 77% of “future-ready” organizations plan to further develop their ecosystem partnership strategies at scale within the next three years.

Send this link when… You’re ready to get proactive with your partnerships strategy and need buy-in from your internal teams, more headcount, and better resources to bring your ecosystem roadmap to life.

PayPal partnered with Honey, a coupon browser extension, to drive more conversions in the beginning phases of the buyer journey. Then, in 2019, they bought Honey for $4 billion.

Through the partnership and ultimate acquisition, Honey got access to PayPal’s 24 million merchant partners, and PayPal got a leg up on competitors like Amazon Pay by engaging buyers on e-commerce pages through Honey’s web browser extension.

A 2021 article on Benzinga says PayPal is winning the fintech war for two reasons:

- Security

- Global partnerships

Send this link when… You’re planning a defensive play to beat out your all-in-one competitors, or you’re pitching strategic partnerships as potential acquisition prospects.

Rajiv Ramanan, the previous Director of Startup Program and Technology Alliances at Freshworks, developed a three-step co-selling framework with integration partners to team up in targeting their most strategic overlapping accounts. The customer and employee engagement platform has closed deals 50% faster than any other sales channel by getting introductions from partners through this framework.

Additionally, Freshworks has observed that its customers are 30% less likely to churn when they’ve adopted one integration (compared to 0) and 60-80% less likely to churn when they’ve adopted five integrations or more. As a result of gathering this metric:

- Freshworks’s CSMs understand how partnerships impact their roles and have led a 30% increase in integration adoption within one year.

- Integration adoption has become a key metric and objective and key result (OKR) for Freshworks’s CS team in 2022.

- Freshworks’s sales development representatives (SDRs) and solutions engineers (SEs) actively request resources relating to integrations during the sales cycle, and Freshworks’s AMs and CSMs are excited to leverage integrations for upselling and cross-selling because they see their tech ecosystem’s impact on customer satisfaction and retention.

Send this link when… You want to double down on a co-selling workflow between your team and your tech partner’s team to close more opportunities together, or you need to get buy-in from your pre-sales and post-sales teams.

Atlassian’s ecosystem includes more than 300 partners.

Rather than offering all of its services in-house, Atlassian lists the following reasons why they (and you) should rely on partners to provide services to customers:

- Larger companies often require a high-touch sales experience, something a volume-based business can’t always manage on its own

- Customers in global markets may require one-to-one support in their local language

Ultimately, Atlassian did build out an in-house services arm in order to scale, but they also provided certification courses to their partners to help them grow their expertise and provide services of the same caliber as Atlassian’s internal services team.

Atlassian also says its app ecosystem enables its product to address pain points it wouldn’t solve on its own and thus reduces churn.

Send this link when… You need to make the case for recruiting SI and agency partners, or you need to invest in training and establishing a certification program to enhance your channel partner program.

Chris Messina, Vice President of Alliances and Partners at LeanData, sought a Director of Partnerships with Ecosystem Ops experience to join his now four-person partnerships team. The goal? Build out Salesforce dashboards for partner attribution to uncover insights that could guide the sales and partnerships team’s work. In September of 2020, Derek Safko came on board.

As a result, Chris’s team is able to track partner-influenced revenue and has observed that deals with partners have a 40% higher AOV than deals without partners.

“Clearly there’s a meaningful reason to include partners on our deals,” says Chris.

He adds, “Without [ops] it makes it really tough to track everything effectively. It’s always hard to get the ops [team’s] attention when they’re so focused on sales, the CSM team, and [other] ops.”

Send this link when… You want to get more resources or headcount for partnerships — especially if you’re looking for buy-in to hire an Ecosystem Ops specialist.

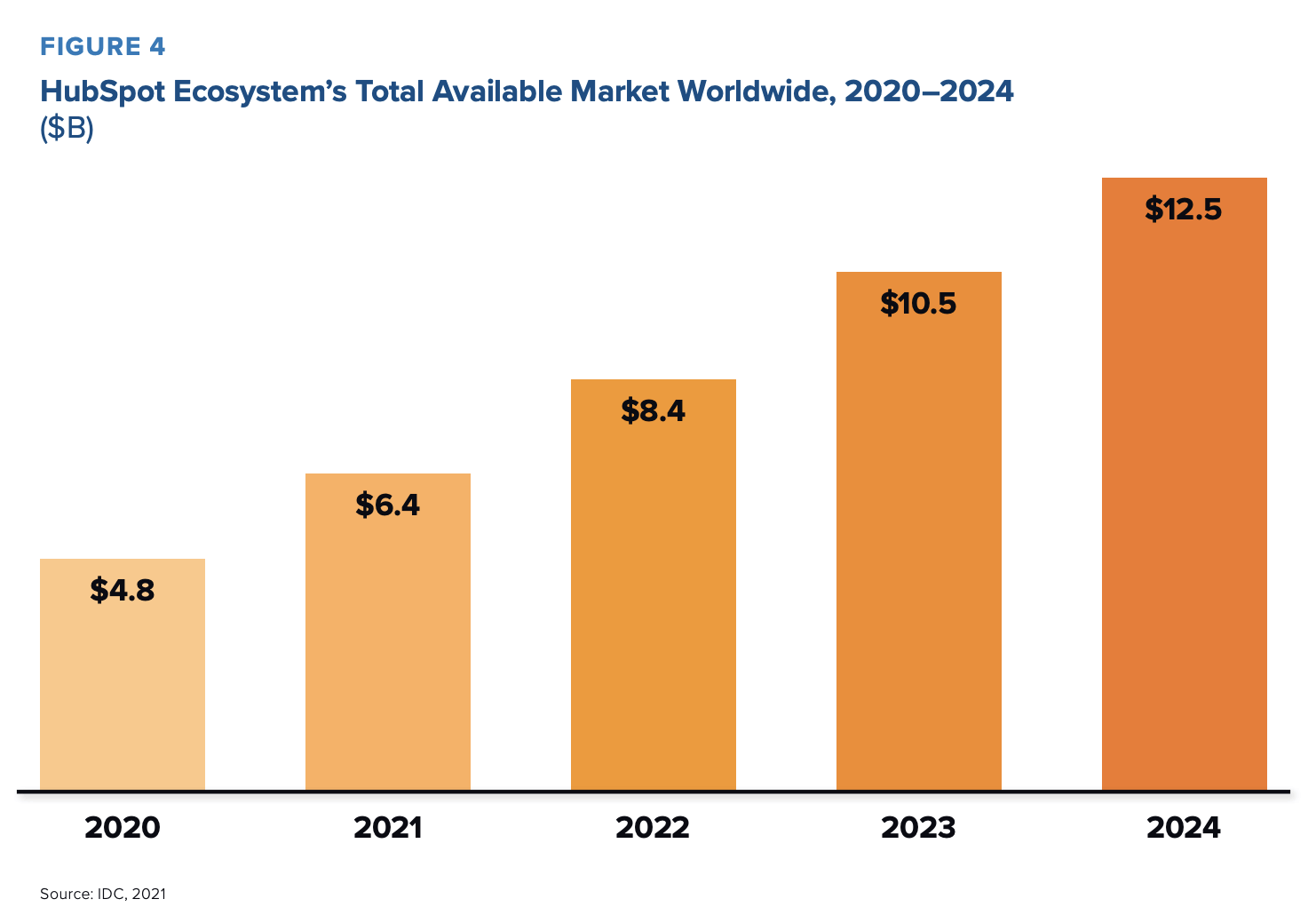

HubSpot and global market intelligence firm International Data Corporation (IDC) published a white paper sharing HubSpot’s revenue gains through its app and solutions partners up until 2021 as well as its projected growth. At the time, IDC stated that HubSpot was uniquely positioned to satisfy post-pandemic customers through its all-in-one capabilities combined with its ability to work well with many tech stacks through its extensive tech ecosystem.

IDC predicted that HubSpot will bring in more than $18 billion over the next four years as its ecosystem doubles in size.

In January, 2022, HubSpot’s app ecosystem surpassed 1,000 integrations (just two years after hitting the 500-integrations mark). More than a quarter of HubSpot’s customers have installed more than 10 apps from its tech ecosystem. HubSpot has more than 135,000 customers using their platform and integrations.

Send this link when… You want to demonstrate how channel and tech partners can enhance your platform and offer customers more value while improving retention. Or, you’re making the case to join the HubSpot tech ecosystem.

Salesforce has one of the largest partner ecosystems in SaaS with more than 4,600 partners. In 2020, Gartner ranked Salesforce the #1 CRM for the 9th year in a row. More than 70% of ActiveCampaign customers use at least one of the customer experience automation platform’s more than 850 integrations. ActiveCampaign also ranks #1 for customer satisfaction in the marketing automation category on G2.

Connect the dots, and you can deduct that ActiveCampaign’s success in the AppExchange is a direct contributor to its retention and “stickiness” among its customers.

To get the #1 spot, ActiveCampaign and Salesforce embarked on a six-month co-marketing campaign involving joint activations at “Digital Summit” conferences, an owned event series called “Study Halls”, partner case studies, and blog content.

Send this link when… You want to get more resources for co-marketing with tech partners. You can also use this article to get buy-in from your marketing team for partner marketing. The higher you rank, the more EQLs you’ll get, and the easier it will be for your marketing team to satisfy their KPIs.

And the dollar amount of those upsells is 4x the rate of upsells with no partners involved.

RingCentral’s ISV Platform partnerships team collaborates with the customer success (CS), solutions engineering (SE), and verticals teams to identify integrations that solve vertical-specific pain points for their prospects and customers. This cross-functional approach lends itself to increasing customer lifetime value (CLV) and influencing upsell opportunities.

The unified communications as a service (UCaaS) company has an entire Solutions Engineering team within the greater SE team that’s dedicated to community development (think: external devs building public-facing integrations), sales enablement, and collaborating with the partnerships team to scope and build the best integrations for their prospects and customers.

When asked about how making partnerships a priority for the SE team has benefited the business, Dave Hamel, Manager, Solutions Engineering, Applications and Development, says, “A lot more partnerships, a lot better integrations, and the development time from interest to application on the gallery and to people being aware of the partnership has definitely truncated.”

Send this link when… You’d like to make working with partners an organic part of each of your GTM teams’ strategies, and you generally get a high volume of ad hoc integration requests from customers.

Gorgias, an e-commerce customer service helpdesk platform, was able to increase partner-influenced revenue by 30% with the help of Crossbeam. As a result of the increase in revenue, the Gorgias team was able to onboard an additional 10 partnership roles in less than a year.

“Because we had such great success with revenue on the partnership side, it added fuel to the fire to add more partner managers to try to tap into all the potential markets… expanding internationally, having more presence in EMEA and APAC,” said Chris Lavoie, Senior Technology Partner Manager at Gorgias.

How Gorgias did it:

- Adopting its PEP, Crossbeam

- Investing in Partner Cloud integrations, like Crossbeam for Slack

- Setting up co-selling guidelines and templates

- Automating parts of their co-selling process around how their sales teams and partners collaborate

Send this link when… You need buy-in to adopt a PEP and get more headcount for your partnerships team.

Excluding its partner Mailchimp, Intuit grew its online ecosystem revenue 37%. That means Mailchimp accounts for a 37% boost in revenue! Intuit acquired Mailchimp for $12 billion in 2021 and CreditKarma for $3.4 billion in December of 2020.

Intuit says its joint integration with Mailchimp served as an entry point for initiating the acquisition of the email service provider (ESP).

Send this link when… You want to convince your CEO to invest in integrations over features, and you have a strategic partner in mind with a big-picture vision (like an “exit event”).

In 2021, Splitit announced its third consecutive year of 200% year-over-year growth. Its annualized merchant sales volume (MSV) (think: its partners) — or units sold — rose 94% in 2021.

Splitit Chair Dawn Robertson said, “Splitit is pleased to report a strong first half, with the delivery of 94% YoY MSV growth, along with growth across other key metrics of revenue, merchants and shoppers. The ongoing development of our new product innovations, including Splitit Plus, and our strong global partnerships, are expected to provide more and more opportunities to increase ongoing acceptance as we pivot from a period of foundational build, into a period of scaling up.

The global installment payment provider credits partnerships with Stripe, Visa, and Mastercard for enabling innovation in its platform.

Send this link when… You’re looking for buy-in to build out-of-the-box tech, channel, and strategic partnerships, or you’d like to expand your e-commerce ecosystem.

Salesloft attributes its success to a series of innovations, including:

- The releases of Cadence Outcomes and Deal Engagement Score

- The acquisition of revenue consulting firm InStereo

- Integrations with Microsoft Teams and Google Meet, and native support for Zoom and Webex integrations, as enhancements to its Conversations product

A leader in The Forrester WaveTM: Sales Engagement, Q3, 2020, Salesloft has the highest score available in partner and customer ecosystem. It has more than 120 partners.

Send this link when… You want to balance best-in-breed capabilities with an all-in-one ecosystem approach — both of which will help to make your product an indispensable part of your customers’ tech stacks.

Mike Stocker, VP of Strategic Partnerships at RollWorks, has been using Crossbeam for more than a year to inform the account-based marketing (ABM) platform’s tech ecosystem strategy and co-selling motions. In 2021, RollWorks trained its onboarding success managers (OSMs) in using Crossbeam — and the Senior Manager of Adoption and Onboarding at the time, Erez Suissa, was 100% on board.

“To unlock more value for our customers in the early days makes so much sense,” said Suissa. “I’m a firm believer that customers have a life cycle, and the onboarding role is not to do everything under the sun, but it’s for us to basically help the customer realize the immediate value. We need to unlock that as quickly as possible for them.”

Since June 2021, partners influence approximately 80% of RollWorks’s deals, and deals with partners have a 10% higher ACV and close at a 66% higher rate than deals without partners. Additionally, RollWorks’s onboarding success managers have used Crossbeam to increase their time to first value (TTFV) by 16% and increase integration adoption by 17%.

Send this link when… You want to put the dev resources and marketing budget behind your tech ecosystem and use integrations as a growth strategy for driving retention, renewals, and account expansions.

Satya Nadella, CEO at Microsoft, and Amy Hood, Executive Vice President and Chief Financial Officer at Microsoft, attribute the company’s $32 billion in revenue during Q2 of 2019 to partnerships.

In a 2019 press release, Nadella said:

“Our strong commercial cloud results reflect our deep and growing partnerships with leading companies in every industry including retail, financial services, and healthcare. We are delivering differentiated value across the cloud and edge as we work to earn customer trust every day.”

Nadella plans to unlock trillions of dollars in partner opportunity. He believes in Microsoft’s partners so much that he’s working on identifying how each major internal business change will affect the company’s partners.

If only you could bring Nadella to your buy-in meeting!

Since Nadella became CEO of Microsoft in 2014, he has adopted an “Ecosystem Management approach” — shifting Microsoft’s priorities from an all-in-one solution to a “cloud services and subscription platform company”. Microsoft now has more than 300k partners in its ecosystem and has grown its business by more than 80% since 2014.

Microsoft calls itself a partner-first company. Since Nadella joined, the company has shifted:

Send this link when… You want to share an example of a now Supernode that has historically looked to partnerships as its main source of revenue and growth. Also send this link to your CEO if you’re an agency or SI company looking to get more headcount and resources dedicated to investing in a Supernode’s ecosystem.

Through a study conducted by Forrester Consulting, Impact.com shared that companies with mature partnership programs make $162 million more on average than companies with low partner program maturity. According to Impact.com, high maturity partner programs prioritize improving their Ecosystem Ops for scalability and targeting new types of partnerships.

(Psst! Take our tech ecosystem maturity diagnostic to see how your partner program stacks up against your peers in the industry).

Send this link when… You need to make the case for investing in Ecosystem Ops and/or hiring a new team member that can help lay the foundation for the success of your partner program.

In 2020, Highspot reported that more than 45 companies switched from their competitors’ platforms to theirs and that the company ranked #1 for customer satisfaction in the sales enablement vendors category on G2. The Highspot team cites its 25 Sales Acceleration Partners as playing a critical role in providing content and expertise to their shared customers.

Send this link when… You’d like to invest in your channel partner program and prioritize partner enablement to help your partners provide more value to your shared customers.

Vidyard 14x’d its partner-sourced revenue in 2020 with the help of real-time account mapping in Crossbeam. The video software company increased its quarterly partner-sourced pipeline for its tech partner program from $25K in 2019 to $350K in 2020.

Additionally, when referencing a piece of the prospect’s tech stack in an outbound message, Vidyard saw a 20% increase in response rates. (Psst! Check out #15 for insights on learning your customer’s tech stack with Crossbeam.)

Send this link when… You want to build the case to adopt a PEP and empower your team with partner data on the fly.

Salesforce continues to achieve record highs in overall revenue year over year. In the 2018 fiscal year, Salesforce grew to $10.48 billion — based nearly 100% on CRM. Salesforce has more than 4,600 partners to date, with more than 4,400 tech partners and more than 250 channel partners. These partners contribute to the “stickiness” of Salesforce as a CRM, influencing their shared customers ability to maximize value from the platform while using their preferred tech stacks.

Speaking of the value of partnerships, this reminds us of a little story…

On the Partner Up podcast, Bobby Napiltonia, the creator of Salesforce’s Enterprise Channel Partnerships Program in the early 2000s, spoke about how Salesforce first expanded into the financial services market. At the time, financial services companies relied on the “black book” for tracking the sales cycle.

Napiltonia says that the first financial services firm Salesforce targeted was Merrill Lynch — a deal brought to Salesforce by a partner.

“I remembered the day we called [the partner] to say, ‘Hey, we have a Publishers Clearing House check for you’ — and it was $543,000, or 10% of the five-million-dollar deal. And we were all happy because I got to show every other partner, ‘Guess what? You, too, can get half-million-dollar checks from us.’”

Did you know: Salesforce’s ecosystem will generate $6.19 for every $1 Salesforce makes by 2026?

Send this link when… You want to invest in an out-of-the-box partnership that could open the door to entirely new markets, or you’d like to invest in developing integrations for the Salesforce ecosystem.

SignEasy was first-to-market with its strategic partner Apple in 2021 — meaning the e-signature tool made its way into the hands of the more than one billion iPhone users before any of its competitors.

It’s no coincidence. SignEasy plans its product roadmap in alignment with Apple’s iOS releases. In the past, they were first-to-market in offering a widget capability, which provided easy access to documents on an iPhone user’s home screen, and Apple pencil functionality, which enabled users to handwrite their signatures on iPads.

Being first-to-market gives SignEasy a competitive edge by making it easy for Apple to promote SignEasy’s new functionalities in tandem with Apple’s. Meanwhile, other companies are racing to support Apple’s newest features.

Aragon Research named SignEasy an “Innovator” in its 2021 Digital Transaction Management Globe Report for its product innovation.

Send this link when… You want to align your product roadmap or GTM strategy with your strategic partner’s product launches. You’ll need the dev resources, marketing team buy-in, and more to be first-to-market and come out ahead of your competitors.

In 2019, SPH spent just a few months localizing Monday.com’s campaign through its knowledge of South Korean culture and best practices for lead conversion. For example, many of Monday.com’s new South Korean customers favored phone over email and were using the project management software to sort through their overflowing and daunting email inboxes.

Monday.com’s fast growth accelerated the previously “unprofitable” company’s success and ultimately led to its initial public offering (IPO) filing in 2021.

Send this link when… You want to rely on a partner to accelerate your company’s entry into a new market.

Google acquired business intelligence platform Looker in 2020, just four years after establishing their strategic partnership. Looker continued to operate as an independent business and launched its first round of business intelligence and analytics platform updates in 2020, which included Looker Blocks for Google Marketing Platform.

Google saw the value data governance and management brought its customers throughout their partnership and saw acquiring Looker as an opportunity to standardize data across multiple cloud softwares.

If all these positives don’t do the trick, take a look at Crossbeam CEO Bob Moore’s reaction to the acquisition back when he ran the show at his all-in-one business intelligence (BI) platform and Looker competitor, RJMetrics:

My $2.6 billion ecosystem fail.

Send this link when… You want to dedicate resources and headcount to ensuring your strategic partnership is successful year after year. Or you need to convince your CEO that your product should operate as a best-in-breed offering while relying on partners to fill product gaps and to help your product adapt to your customers’ unique tech stacks.

Casey Hill, Head of Growth at personal video platform Bonjoro, believes the SaaS sales cycle relies most heavily on partner referrals or word of mouth. Hill says that Facebook Ads, pay-per-click (PPC), and other traditional marketing tactics lack the power that partners have in establishing personal relationships with prospects on your behalf.

A partner vouching for you and showing your potential customer how your integration would improve their workflows and their revenue is like hearing good things about a new local restaurant from a trusted friend — you’ve got to go try it for yourself. It could mean all the difference between a lead going dark versus advancing to a qualified opportunity.

Hill says Bonjoro’s integrations have increased the company’s customer base by the thousands, while improving its CLTV, reducing churn, and helping it stand out against its competitors through its best-in-breed service that jives with many of its customers’ tech stacks.

Send this link when… You want to put more budget behind your GTM strategies with tech partners and/or invest in improving your co-selling strategy.

Partnerships can benefit every stage of the customer lifecycle. Account mapping at each stage can help you understand which partners to reach out to for help and when to drive the best results. For example: for the “Awareness” stage, you can develop a co-marketing play if there’s a high overlap count between your prospects and your partner’s prospects. In this case, the goal is to generate leads.

Send this link when… You want to develop an account mapping strategy to maximize results at each stage of the customer lifecycle and empower each team with partner data.

—